Essential Finance Concepts and Formulas You Should Master

In the last newsletter, I delved into Compound Interest and its ability to aid the steady accumulation of wealth. In today’s Newsletter, I further explore the topic and other key finance concepts.

As I sat there, contemplating the weight of the decision before me, I couldn't help but feel a sense of fear and uncertainty. The thought of potentially committing to a career path that may not be the right fit for me filled me with dread. "What if, after two years, I realise that this job is not for me? Would I be trapped in a position that brings me nothing but misery?" These were the thoughts that plagued my mind, as I weighed the pros and cons of two job offers that had been presented to me.

But, as I look back on that moment, I am filled with a sense of gratitude and contentment. For, despite my initial doubts and fears, I decided to take the path that I am currently on. And, as it turns out, it has brought me nothing but joy and fulfilment.

However, I cannot deny the opportunity cost of the decision and the potential outcome of the other decision. But, as a wise friend and mentor once said to me, "In life, there are many paths and outcomes to the decisions we make. We can never know for certain which is the 'right' one, but we must accept the decisions we make and make them work.

Today's newsletter will delve into the essential financial concept of opportunity cost, which should play a significant role in personal and financial decision-making. Additionally, we will explore a few other crucial financial concepts to help you make informed decisions.

Opportunity Cost: This simply refers to loss of other alternatives when one alternative is chosen. That is the value of what you lose when choosing between two or more options. This is easily overlooked. However, understanding this concept would allow for better decision-making.

Opportunity cost can easily be visualised with a simple formula:

BFO - OC

Where: BFO: Best Forgone Opportunity; OC: Option Chosen

Say you have N900k and two choices; buy a new MacBook Pro M2 laptop or invest that money for a year at a 12% interest rate per annum. Buying the laptop is expected to improve your productivity and increase your earned income by 10% per year. After careful consideration, you buy the laptop.

The opportunity cost of the decision is 2% (12%-10%) extra return forgone.

Well, this is not all. In the example above you did not consider inflation in deciding to either invest or buy a new laptop. This is a perfect segway to the next concept; the Time value of Money.

Time value of money: The time value of money is a central concept in finance, the idea is that money in hand today holds more value than the same amount received at a future date, say a year down the line. This concept is intimately tied to both inflation and earning potential. For instance, if you happen to reside in Nigeria in 2022/2023, you're likely aware that purchasing an item today for a certain amount will not cost the same amount 2 or 3 months from now. In other words, your purchasing power is eroded over time by inflation. From an earning perspective, putting aside 1000 naira in a savings account with a 10% interest rate in 2020 is significantly more lucrative than receiving the same amount in 2023 for free. This can be shown using a simple formula:

FV = PV (1+i/n)^n×t

FV: Future Value (Amount to be received at a later date)

PV: Present Value (the amount today)

i: Interest rate

n: Number of compounding periods per year

t: Time (Number of periods or years)

^: rise to power

Using the Future Value formula on the example of 1000 naira, invested for 3 years, assuming it is compounded annually; the future value would be:

1,000 (1+0.1)^3 = 1,331.

For the 2023 sum of N1,000 to hold the same value as it did in 2020, it must be invested for three years. This assumes that the initial N1,000 investment made in 2020 is not reinvested, or that the 10% interest rate which was secured in 2020 is still available by the time 2023 rolls around.

Return on investment: Return on Investment popularly known as the “ROI”, is a simple measure of the profitability of any investment. At any point in time, it gives a gauge of how well an investment has performed and allows you to compare it with other similar investments.

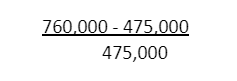

It is calculated as:

Let’s say you purchased 1000 USD dollars at N475 in 2021 and sold at the end of February 2022 for N760. Your ROI would be 60%

For investments with a series of cash flow, another finance metric can be better used to measure profitability; the Net present value.

For instance, you plan to purchase an apartment for $120,000 through a 3-year 10% interest rate loan. The apartment would be rented out and would generate $30,000 annually in rental income after maintenance expenses. The NPV can be determined using the formula below:

NPV= ∑ R/(1+i)^t

Where R is the net cash flow at a time

i is the discount factor

t is the number of periods

Assuming a discount rate of 10%, the present value of the cash inflows would be:

Year 1: $30,000 / (1 + 0.1)^1 = $36,363.64

Year 2: $30,000 / (1 + 0.1)^2 = $33,057.85

Year 3: $30,000 / (1 + 0.1)^3 = $30,052.59

The sums up to $99,474.08 compared to the $120,000 invested; the NPV is -$20,526. This shows the investment would be unprofitable.

The Net Present Value or NPV measures the difference between the present value of an investment's cash inflows and the present value of its cash outflows. A positive NPV indicates that the investment is expected to be profitable, while a negative NPV indicates that it is expected to be unprofitable. One key advantage of the NPV is the consideration of a discount rate (i). It is simply the baseline or least rate of return that you expect an investment to exceed to be worthwhile. In the example above, the interest rate on the loan used to finance the property was considered the discount rate. Ideally, the discount rate is used to factor in the time value of money as mentioned earlier, monies earned in the future are not the same as that of today. The discount rate brings the monies earned in the future to today’s value.

Rule of 72: This is simply a handy way for you to estimate how long it would take any investment with a fixed yearly rate of return to double. You just divide 72 by the annual rate of return to get the number of years it takes to double your investment. That is:

Number of Years to Double = 72 / Annual Rate of Return

For example, if you invest N100k at a 10% annual interest rate.

Applying the formula 72/10=7.2

It would take 7 years and two months for the N100k invested to double.

The Rule of 72 is reasonably accurate for low rates of return. The chart below compares the numbers given by the Rule of 72 and the actual number of years it takes an investment to double.

Debt to income ratio (DIR): While this is mainly used by Banks, it should be of paramount concern for anyone contemplating taking out a loan or any type of arrangement that incurs interest.

It compares your total debt payments (interest and principal) to your total income. It is expressed as a percentage and is calculated by dividing your total monthly debt payments by your gross monthly income (income before tax; however to make it simpler you could use the net income that is, after taxes).

Example: You are a salaried employee with a monthly net income of N300k, who also earns a regular monthly rental income of N35k. You have a car loan, a personal loan and a phone loan, totalling N170k.

The DIR would simply be: (Monthly Debt Payments / Gross Monthly Income) x 100%

DIR = N170k/N335k x 100

DIR = 50.7%

The higher your DIR is, the fewer monies you have to meet other regular expenses including basic living expenses. Considering the example above, say your average basic expenses (Food, Transport, Toiletries…) are N150k. This leaves just N15k or 4.5% of the total income that can be set aside.

The higher your DIR, the more difficult it will be for you to settle your debt. Financial institutions are keenly interested in this ratio when considering new loans to individuals or businesses. You may find them call it DSR (Debt Service Ratio) or DSCR (Debt Service Coverage Ratio).

Net worth: Net worth represents the difference between your total personal assets and liabilities. That is what you own minus what you owe. It can be used to gauge the health of your personal finance at any point in time.

To calculate you add up all personal assets like cash, investment, real estate owned, car and other real personal assets. Then subtract all personal liabilities such as outstanding loans, unpaid taxes, and debts owed for goods/services enjoyed but not yet paid for.

For example, as of today, you have N5 million in assets (Personal assets of 1.5 million, Car with a current value of N1.5 million, Cash of N500 thousand, RSA balance of N1 million and Investment of N500 thousand). Liabilities of N1 million (Personal Loan of N400 thousand and other liabilities of N600 thousand).

Net worth= Total Assets - Total Liabilities

That is: N5 million - N1 million = N4 million.

Interest Rate:

An interest rate tells you how high the cost of borrowing is, or high the rewards are for savings. So, if you’re a borrower, the interest rate is the amount you are charged for borrowing money, shown as a percentage of the total amount of the loan. The higher the percentage, the more you have to pay back, for a loan of a given size. If you’re a saver, the savings rate tells you how much money will be paid into your account, as a percentage of your savings. The higher the savings rate, the more will be paid into your account for a given-sized deposit.

Interest payment by or from you can be calculated using the Simple or Compound interest rate formula.

Simple Interest Rate: Simple interest is a type of interest that is calculated based only on the principal amount borrowed or invested, without taking into account any interest that has been paid over time.

For example, you borrow N5 million at 10% for 3 years. Using the simple interest rate formula:

Simple Interest = (Principal x Interest Rate x Time)

The interest due would be N5,000,000 x 0.1 x 3 = N1,500,000

So, after the end of the loan term, the total amount due would be N5 million borrowed (principal) and the interest due N1.5 million, totalling N6.5 million.

Compound Interest Rate: Unlike simple interest, Compound Interest is calculated on the principal amount as well as on any interest that has accrued over time. In other words, it is the interest earned not only on the initial principal amount but also on the accumulated interest.

You can calculate compound interest at different intervals, such as daily, monthly, or annually. The more frequently interest is compounded, the faster it grows. This is because each time interest is compounded, it is added to the principal amount, and the next calculation is based on the new, higher principal amount.

The formula for calculating compound interest is:

Amount = P(1+r/n) ^(nt)

Where:

A = the amount of money due

P= the principal amount

r= the annual interest rate

n= the number of times the annual interest rate is compounded

t= the number of years.

Using the previous example but interest is compounded quarterly

A= N5,000,000 x (1+0.1/4)^(3x4)

A= N6,724,444.12, that an interest payment of N1,724,444 compared with N1,500,000 using the simple interest rate formula.

In a previous newsletter, I shared a comprehensive analysis of the advantages of compound interest, an essential tool for wealth creation. If you still need to become familiar with this subject, I recommend reading this newsletter.

Growth rate: I am sure you are familiar with calculating changes in figures over time, that is growth rate. You would be most familiar with the percentage change, which measures the difference between two values expressed as a percentage of the original value. This is a valuable tool in personal finance to understand performance.

The formula is: (New Value - Old Value) / Old Value x 100% or

(New Value/Old Value)-1 x 100

For example, if the price of a share was N250 at the beginning of a week. At the end of the week, it now selling for N234.

The share declined by 6.4% (16/250 x 100 or (234/250)-1 x 100)

Another way to calculate a growth rate is through compounded annual growth rate.

Compounded Annual Growth rate (CAGR): a measure of the annual growth rate of an investment over a specified period, taking into account the effect of compounding. “It represents one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios, and anything that can rise or fall in value over time”. It can help you smooth out distortions or noise in returns or values over a period.

It can be calculated using this formula:

CAGR = (Ending Value / Beginning Value)^(1 / Number of Years) - 1

For example, suppose you invest N2 million in a mutual fund (this fund is subject to market conditions) for four years and it yields 7% (N130k) in year one, 4%(N80k) in year 2, 16%(N310k) in year 3 and 13%(N255k) in the final year. To determine the total return you can use the average growth rate over the years, however, the CAGR is better, as a more concise rate is arrived at.

CAGR = (N255 / N130)^(1 / 4) - 1

CAGR = 18%, which is the growth rate over the 4 years compared to 10% if you used an average ((7%+4%+16%+13%)/4 =10%).

If you've made it to the end of this article, I just wanted to take a moment to say thank you. Your dedication and interest in my content mean the world to me, and I appreciate your support. If you enjoyed this article and found it valuable, I would be thrilled if you could share it with your friends and family. By doing so, you'll be helping us reach more people who can benefit from our community. And remember to come back for another interesting read before the end of the month!