Navigating the uncertainty of the current Nigerian economic climate

Here's a Tweet that would definitely resonate with you currently.

The cost of living in Nigeria is expensive. The cost of leaving Nigeria is more expensive.

A few months after the 2023 presidential elections, I moved into a larger apartment, which was a much-needed upgrade after years in a cramped space. However, with a new space, there come some additional expenses. As a result, I needed to purchase some items, with the priorities being a fridge and a microwave. As a lover of good food, these were non-negotiable items for me.

I started my usual routine: researching, comparing prices and budgeting. Jumia had some decent offers, but I wanted to see the options at physical stores too. I was being cautious, knowing that I would be happy with the slightest difference in price. I found a Hisense fridge for N205,000 at Ikeja. I spoke to the seller, and we agreed I would come the following week to inspect and make payment.

I called as planned stating I would be coming shortly, but when I arrived at the store, I was hit with unexpected news—the price had gone up to N232,000! In just one week, the cost had jumped by 13%. I was stunned.

This is the reality for many Nigerians right now. Ever since the Tinubu administration decided to float the naira and remove the petrol subsidy (well cut down on the subsidy), prices have been all over the place. The microwave I bought late last year for N38,000 is now N79,000. The fridge I got for N232,000? It’s now N420,000! The cost of most household items and foodstuffs has significantly increased, in most cases more than doubled.

Planning for the future has become a guessing game. Individuals and businesses alike face the tricky task of predicting the next event and making informed projections about the state of the economy. This is absolutely crucial for effective planning and budgeting.

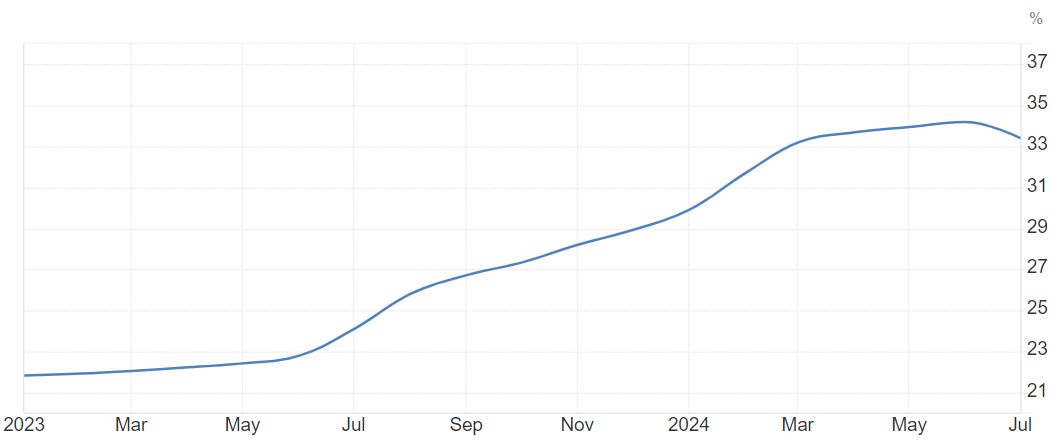

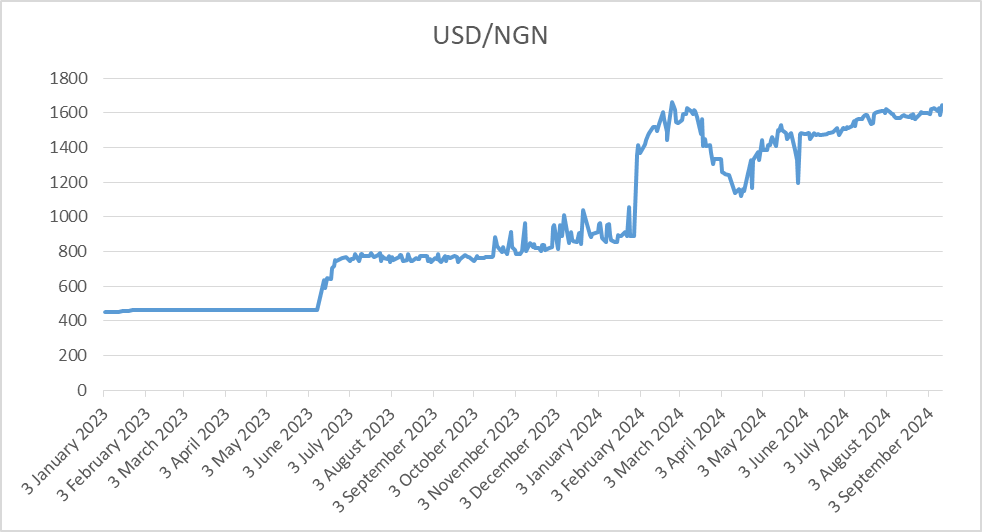

The Nigerian economy has undeniably faced significant volatility over the past year and a half. You can see this in two crucial macroeconomic indicators: inflation and the exchange rate, both of which have largely shown an upward trend. See the chart below for details.

Inflation Year on Year: Trading Economics

USD/NGN Exchange Rate: CBN

When people or businesses sit down to make a budget, they usually do it with some expectations in mind. These expectations need to hold for the budget to work. Take this example: you’re budgeting with a salary of N300,000. You decide to allocate 30% to food, 20% to transportation, another 20% to savings, and the last 30% to other things like entertainment.

While making these decisions, you’re assuming that the cost of things will stay more or less the same. So, if you bought chicken last month for N10,000, you’re expecting it to cost the same next month or maybe, at most, N12,000 if you’re being cautious. You’re also hoping that fuel prices will remain steady because that affects how much you spend on transportation.

But, as we all know, that’s not the case in Nigeria right now. Managing money and sticking to a budget is tough, especially with inflation over 30% and food inflation shooting at almost 40%.

Saving for things feels impossible as prices keep changing so fast that you might not even pay the same amount for something just two weeks later. The TikTok video below really shows this struggle well.

So, What Can We Do?

One strategy that has worked for me is buying in bulk, especially when it comes to food items. By purchasing items in bulk, I can secure discounts and buy them at lower prices compared to purchasing them individually later on.

Here are a few other tips to consider:

Buy now: If you’ve got a big purchase planned, don’t wait. Do it now. If you can borrow money from friends interest-free, go for it. Chances are, it’ll only get more expensive later.

Drop brand loyalty: Big brands usually come with a higher price tag, and with inflation and fluctuating exchange rates, these prices will only go up. Look for cheaper alternatives.

Cut cost: With prices rising, disposable income takes a hit. Most people’s income won’t keep up with these cost increases, so you’ll need to tighten your belt a little. Cut down on non-essentials like gym memberships and entertainment, and maybe eat out less and cook more at home.

Reassess your loans: To fight inflation, the Central Bank is likely to hike interest rates, which means loans with variable rates will get more expensive. You have two options: pay down the loan now or stick to your current repayments. Paying down the loan reduces your interest but needs a lot of cash upfront. Sticking with your current payments may be better if your current rate is lower than what’s available for new loans. Banks tend to pass on rate hikes to existing customers, but not always fully, to avoid defaults. However, new loans will reflect the current high rates. For example, if the Central Bank increases by 4%, the Bank may pass only 3% to existing customers. This is done to reduce the interest burden on existing customers which may result in increased defaults.

Capitalise on High Volatility: As mentioned earlier, high inflation usually means high interest rates, which can be good news for savings and investments. If you have some spare cash, think about putting it in fixed deposits, treasury bills, or bonds to benefit from these high returns.

Be flexible in your planning: In a volatile environment like this, things change quickly. Whether it’s government policies, the economy, or even your personal situation, be ready to adjust your plans as needed.

Hopefully, by this time next year, things will be better, and these tips won’t be as necessary. Until then, try out some of these ideas, and if you have any more suggestions for dealing with high volatility, please share them in the comments.